The Edge - Portfolio Positioning for 2023

Portfolio construction - Goal setting and allocation strategies

Gong Xi Fa Cai to all who celebrate!

Each January, I do a full review of my portfolio and a detailed consideration of how I want to set up for the year ahead. It’s more of a reflection and planning exercise.

In investing, I received one advice early in my career - every now and then, ask yourself - if you were to create a portfolio today from scratch (at today’s market prices), how would it look like? Essentially, forget about how much gain or loss you made on old positions, but think of the kind of portfolio you’d create if you were given fresh funds and blank sheet of paper NOW.

So each year I do just this.

Today, let me take you through my process of yearly review and rebalancing. We’ll cover the following steps:

Performance review

Goal setting for next year

Investment Opportunities for 2023

Rebalancing and Allocation strategies - Asset-class , Regional/Factors/Sectors (including an insight into my own allocation currently)

Stock selection

Let’s begin.

PERFORMANCE REVIEW: How did we do last year?

Here, I assess several metrics such as absolute performance of the portfolio, relative performance versus broader indices as well as the performance of the trades made.

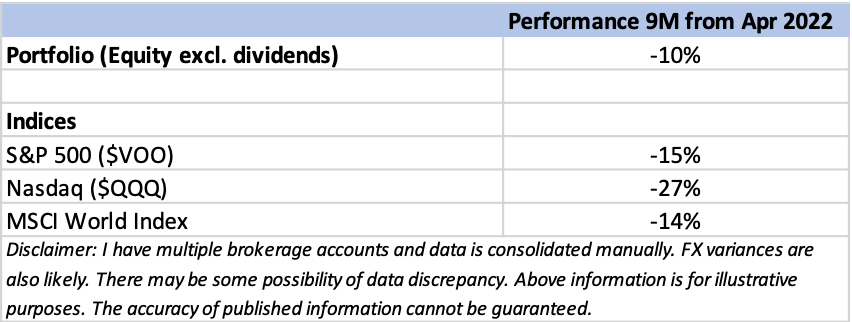

Overall performance / So how DID I do last year? Clearly, 2022 was a tough year on an absolute performance basis after the phenomenal returns we saw in 2020/21. But relative return versus most indices was better. Below is a performance summary since launching The Edge in April 2022.

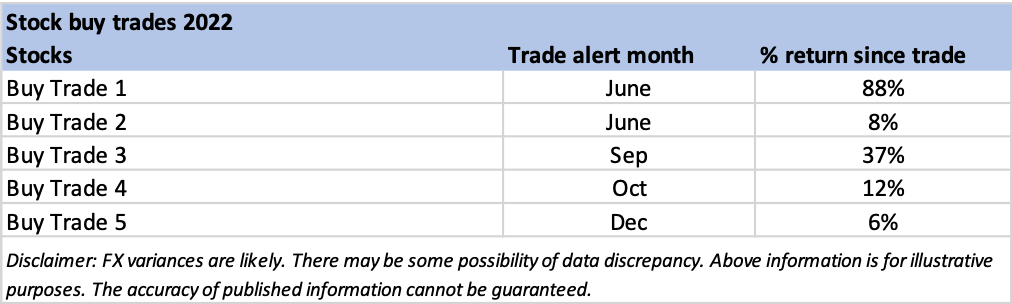

Specific buy trades returns so far: Here is a summary of specific stock returns since adding them to the portfolio since the newsletter launch. I also send these out as trade alerts which can be accessed HERE (available to paid subscribers). Note - All of these names I added to I currently still own in my portfolio.

If one wants to delve deeper into the performance analysis - I also like do is something called an Attribution analysis - it’s a way to analyse what contributed to the excess return of the portfolio relative to a benchmark. It’s tough to manually do this analysis but some brokerages give you this information. e.g. Interactive Brokers.

GOAL SETTING - 2023:

Next, it’s time to set specific, measurable and realistic portfolio targets for this year. It’s important to know what the end goal is before starting to chart out a path i.e. constructing the portfolio in this case!

For example, one might aim to increase one’s networth by a certain % or to earn a certain % return on the investment. Others may just want a steady income stream at retirement. It really depends on the stage of investing journey one’s on to and it is extremely personal.

For me, the quantitative targets involve an absolute and relative portfolio return target on a 1 year and 5 year rolling basis. And also a specific stream of income from dividends and interest.

In addition, it also makes sense to set some qualitative investing goals. Example, learning goals - a new sector or emerging industry one wishes to understand, a new market to expand the investment universe into?

INVESTMENT OPPORTUNITIES FOR 2023 - Studying the market

Next, I like to have a broad view on the overall markets and where the opportunities lie. This is a precursor to planning the overall allocation and then the stock selection.

What kind of environment are we operating in e.g. monetary tightening, too much monetary uncertainty? Are there specific areas of the market that look too oversold (e.g. as we saw global biotechs last year)? Does it make sense to put in some hedges?

I love to believe that “There is a always bull market somewhere!” We just need to look.

For 2023, at this point, these are the OPPORTUNITIES I SEE and MY 7 INVESTMENT HUNTING GROUNDS:

Fixed income / Short dated US treasuries - 1 and 2 year US treasuries are yielding 4.7% and 4.1% respectively at this point. Which looks attractive as an alternative to holding cash / parking excess funds or even for an income stream.

Luxury - It’s quite likely we are heading into a recession in the US and most parts of Europe. Luxury should remain relatively resilient. Some of the names also benefit from China re-opening. Selectively, I see some reasonably valued global names in this segment. Recently added to one per this trade alert sent on Jan 14.