$META - After a 170% rally from November lows, is it time to sell?

Assessing investment case and updated valuation scenarios for $META + Thoughts on tech Portfolio positioning

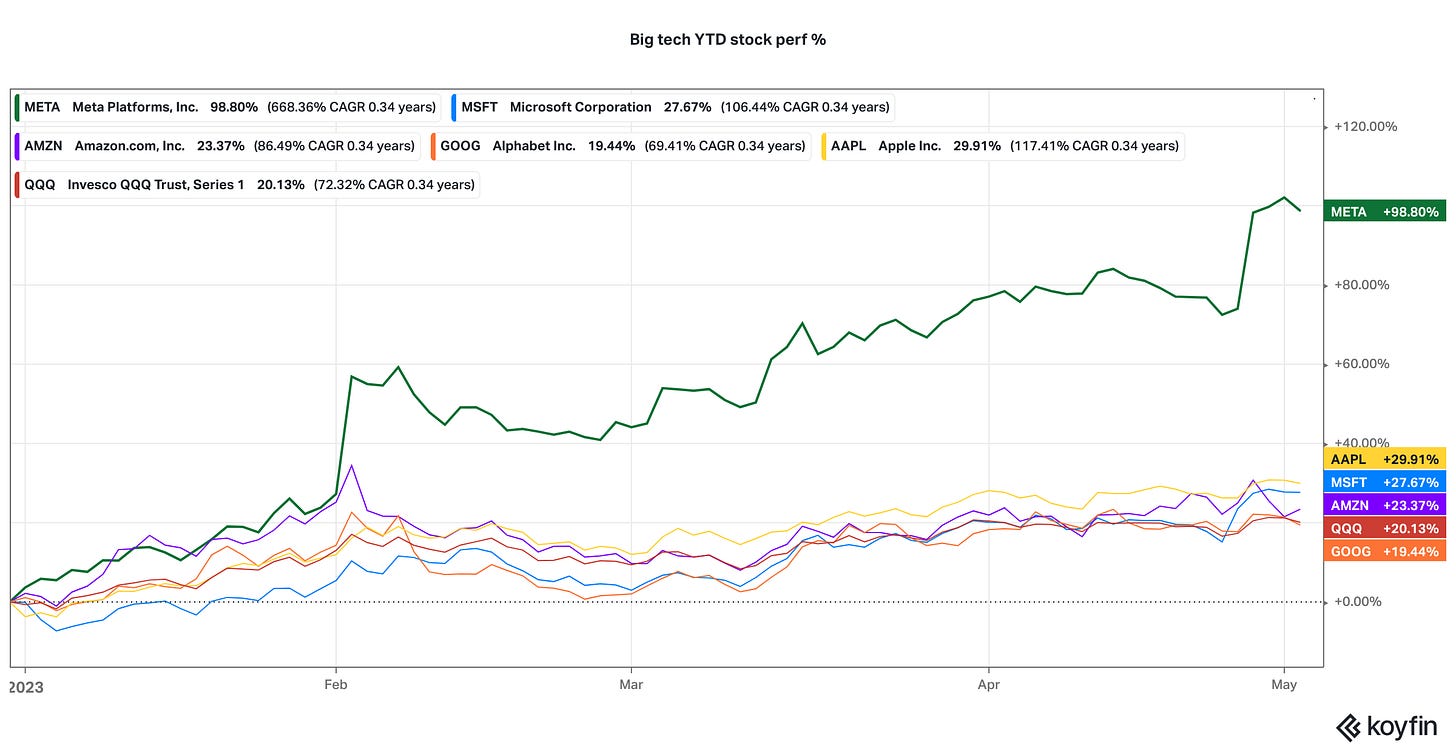

Markets have had a good first four months of the year to start.

Big techs in particular have been a major contributor to positive returns in the market so far this year.

I own some select big tech names in my core portfolio, including META 0.00%↑ which is one of my largest positions.

But with names like META 0.00%↑ having doubled year to date (+170% since its lows in Nov), it makes sense to review these holdings to see if one should think about booking gains yet. In addition, there are some fundamental shifts happening in tech that are making other select names fairly attractive.

So in this note, I will share my analysis on:

Portfolio holdings’ detailed earnings review

Refresh of investment case scenarios / financial model and valuation targets

Share my portfolio’s plan of action / trade plans for select tech stocks in the coming days. Specifically on:

Whether it make sense to start trimming META 0.00%↑ ?

Are there specific names where risk/reward is looking particularly attractive to add?

Which names are on my watchlist and what will trigger me to start buying?