Docusign $DOCU - Potential Turnaround?

Assessing Docusign's restructuring case, earnings drivers and valuation scenarios

It’s admirable when companies create products that tend to become a verb. “Let’s Google this” or “We need a Xerox of this document.” These are companies that create their own new categories of products and become THE player in the specific space.

One similar company has been Docusign DOCU 0.00%↑ - which has created its name in the e-signature space (“Can you Docusign this?”). It’s also a tech company that’s generating positive free cash flow :)

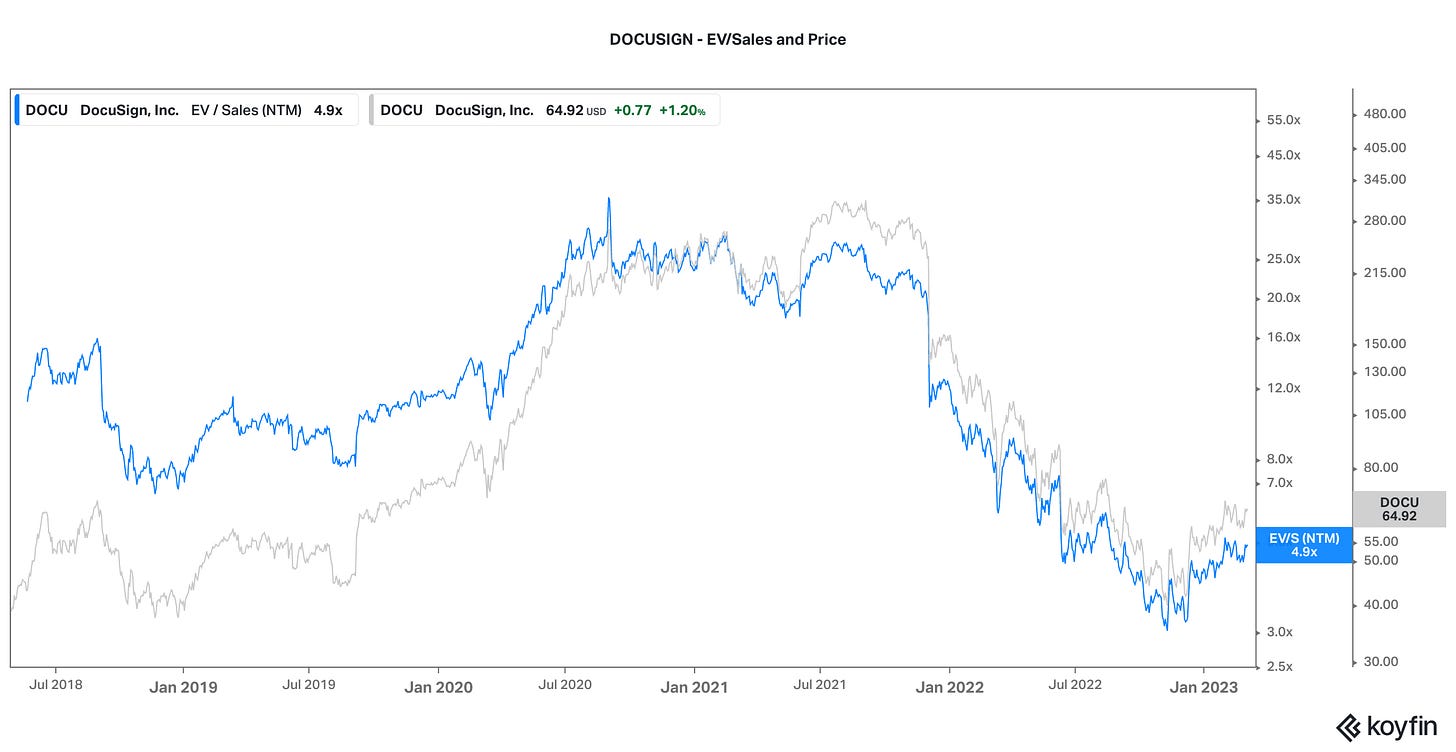

DOCU 0.00%↑ stock has been on my watchlist for some years now but one where valuation always was a problem. But after being a massive Covid lockdown beneficiary - the stock has cooled off ~80% since its peak at the end of 2021. The company now also has a new CEO and senior management team and is in the midst of a restructuring. All this led me to re-assess the name, investment thesis and valuation scenarios.

Below is my investment analysis, where we’ll cover:

Business Overview

Docusign’s Earnings Drivers

Business Risks

Scenarios and Valuation + My price targets

Conclusion

So, what is Docusign? Docusign is an e-signature and contract management cloud service provider. Essentially, enabling companies and people to securely send and sign documents online. DOCU 0.00%↑ is one of the leading players globally, claiming to have 70% market share in the e-signature segment and 1.3M customers. Key competitors include Adobe, Hellosign (now owned by dropbox).

Docusign also provides integration with other applications including that with major players like Salesforce.

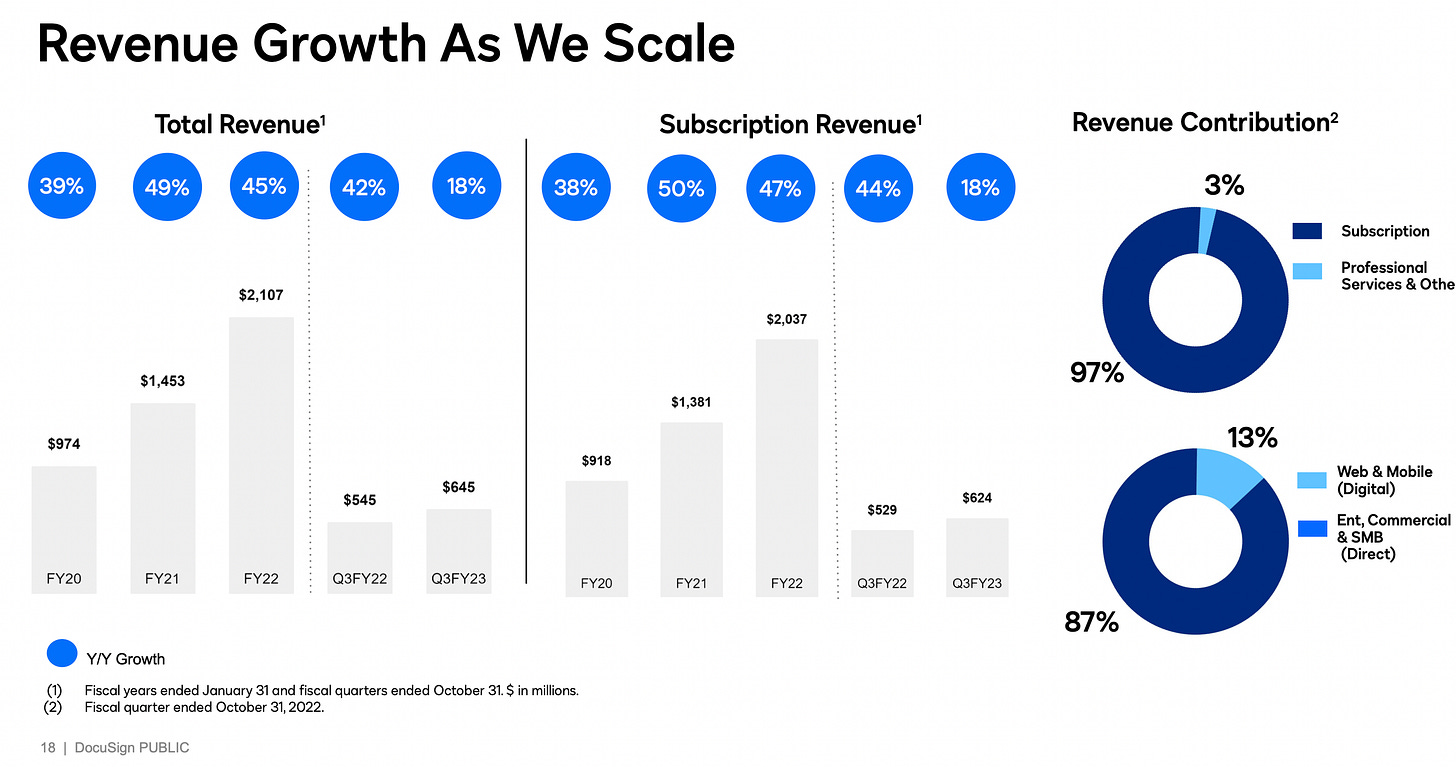

How does Docusign make money? Most of DOCU 0.00%↑ ‘s revenues are subscription based, paid by the party that initiates the contract. e.g. a bank sending a KYC document online to their client for an e-signature - in this case, the bank pays Docusign for the service.

Note almost all of the contracts are pre-paid monthly or annually but the revenue recognition is deferred. Therefore, for modelling and valuation purposes - it makes sense to use “billings” as sales.

KEY EARNINGS DRIVERS:

Docusign hired ex-Google exec, Allan Thygesen as the new CEO in September 2022. (His incentive structure is linked to stock price performance per this SEC filing). Subsequently the company also hired a new COO and Marketing/Sales lead in Jan 2023. With a new management team in place, Docusign is in the midst of a restructuring. The full restructuring plan is yet to be shared but from last earnings release and recent conferences, we have some snippets of the potential direction the company is taking.

Cost Control and Margins:

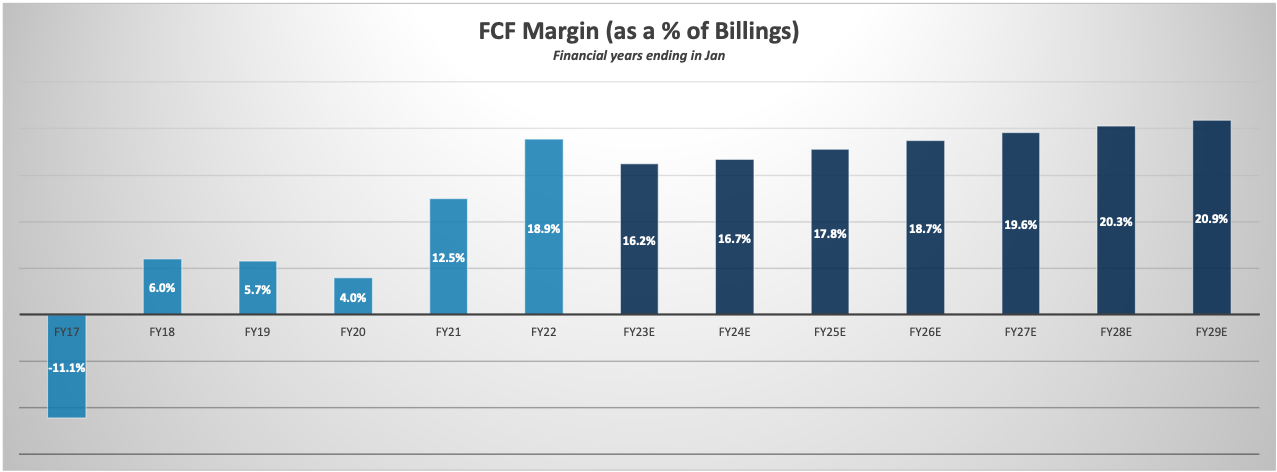

Docusign is already a profitable and positive Free Cash flow generating company. 82% gross margins and the company has demonstrated sizeable FCF leverage with scale.

The main investment thesis relies on the cost efficiency / margin potential post restructuring.

Since the new CEO took over, the company has announced ~20% headcount reduction. Additionally, they are optimising their product sales channels too.

Yet, at the recent earnings release, the co. left the margin target unchanged. Understandably, the macro outlook is challenging but a 20% headcount cut is quite material which should lead to a greater improvement in margins. I believe the co. is keeping a conservation stance, leaving room for potential upside surprise when it comes to margin outlook.

Sales Growth: