Disney $DIS - How does the business model evolve from here?

Are Disney’s challenges already well priced in? Is it time to start adding?

Hello,

I have been reviewing a number of new names for the portfolio these last few weeks - especially ones where stocks have seen material correction or those that represent some structural trends which market may be under-estimating amidst short-term noise.

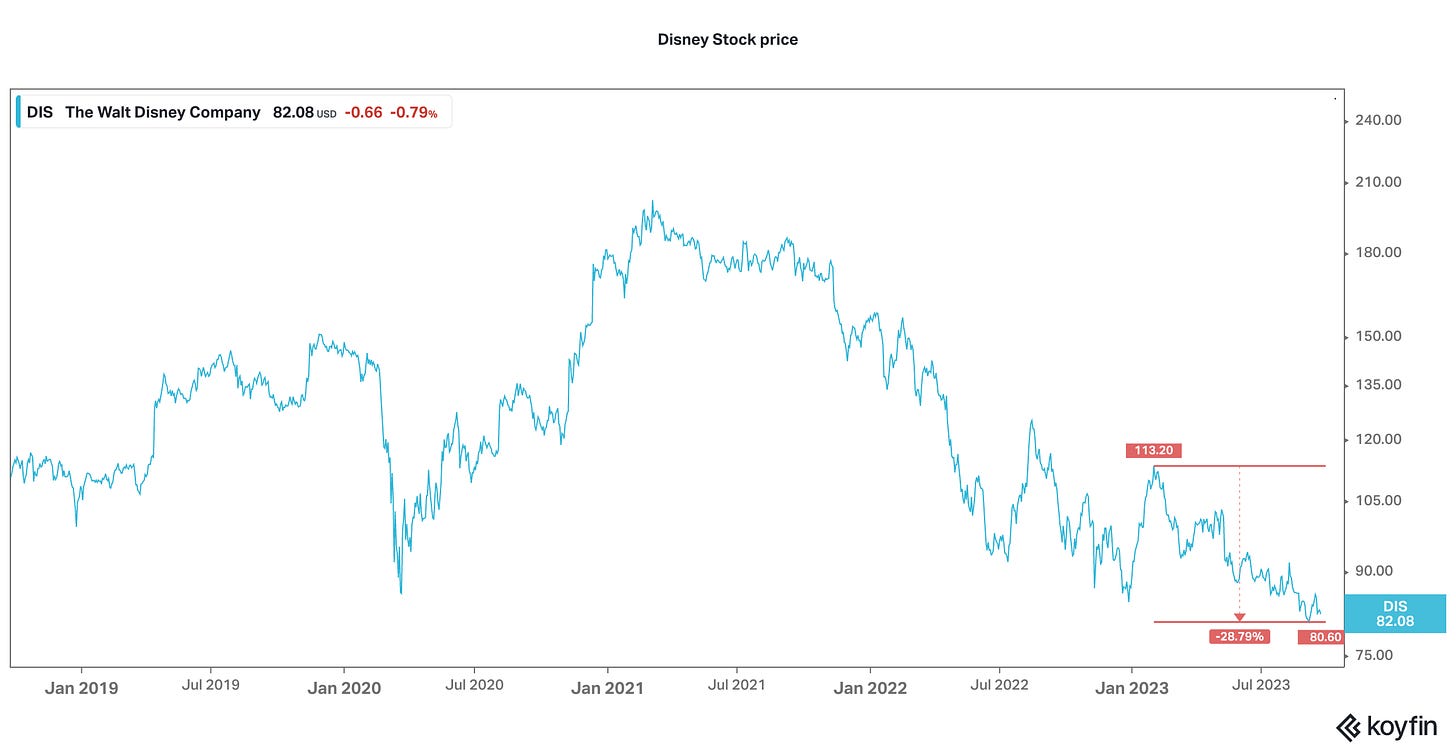

One of the names that has been mired in controversy has been Disney - the stock is down ~30% since Feb 2023 and is currently making a 5 year low.

All for good reason - Disney is in the middle of a complicated business restructuring. Bob Iger has been brought back as CEO late last year to fix a number of structural and cultural issues at the company. And it isn’t an easy task! There are a ton of moving parts and the Disney 3-5 years out will likely look very different from the Disney of today.

In this note, I’ll cover:

What’s driving Disney’s transformation?

A view on how the “evolved” Disney might look like a few years out

Valuation scenarios

My conclusion - Are Disney’s challenges already well priced in? Is it time to start adding?

Let’s go!

Disney - DIS 0.00%↑

Market cap – US$ 150B

A quick overview - Disney’s business revolves around its content and IP. They monetise the IP via multiple channels including theme parks, merchandise, movies, cable and streaming content.

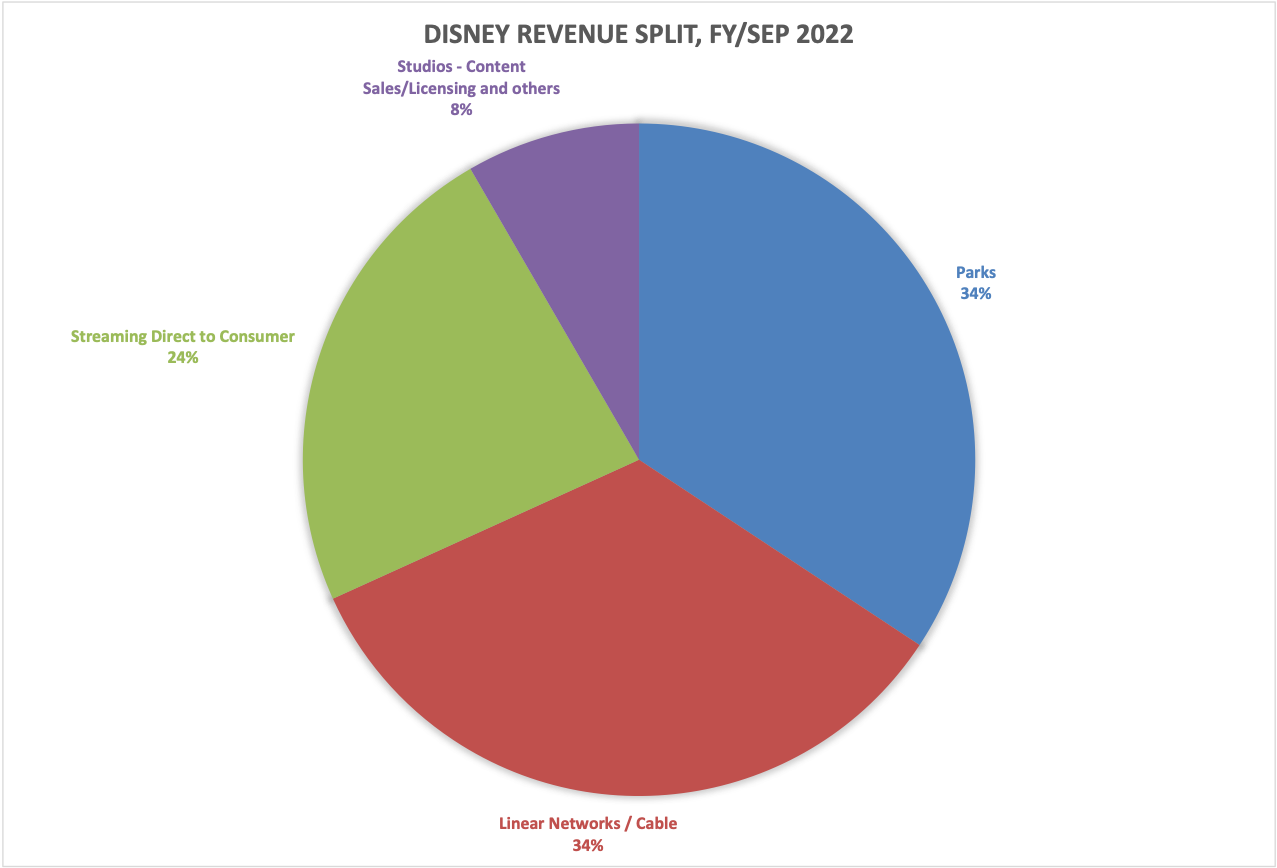

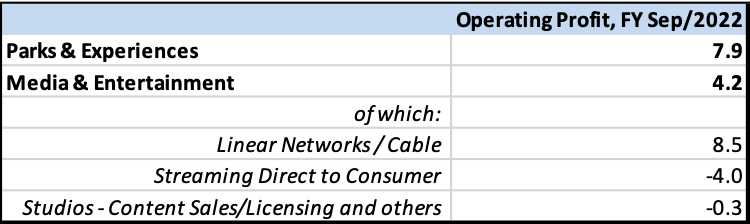

In terms of revenue and profit mix, Media and Entertainment segment (cable+streaming+production Studios) are the biggest contributors, though from a profit perspective Disney’s theme parks and experiences segment is highest margin especially post Covid.

DISNEY’S TRANSFORMATION:

To put it in one sentence - The biggest challenges for Disney today are around Profitability and Debt.

Let’s analyse this in greater detail by looking at specific business segments.

MEDIA & ENTERTAINMENT SEGMENT:

This division includes the cable network broadcasting, streaming (Disney+, Hulu, ESPN+) and production Studios (Walt Disney Pictures, Pixar, Marvel, 20th Century and so on).

The clear issue facing - not just Disney - but the media industry overall has been the shift from cable (the “cord-cutting” movement) to Streaming. Essentially the structural shift in customer preference in how content is consumed.

From a business perspective, this has led to several challenges, namely:

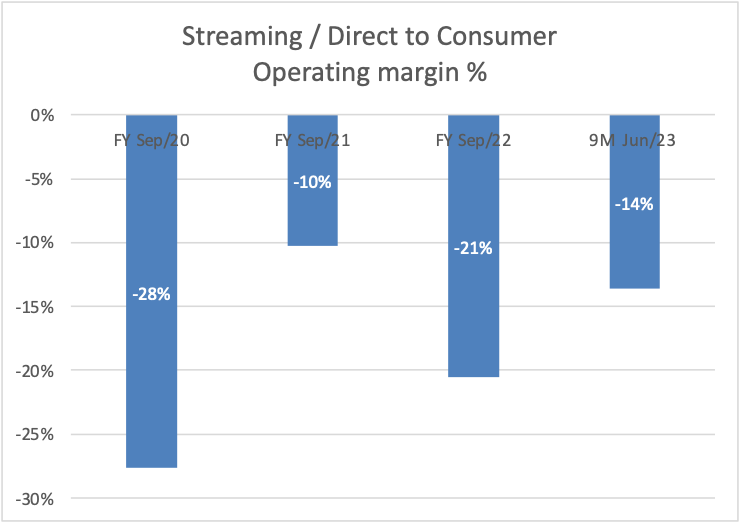

Pure subscription-based direct-to-consumer Streaming isn’t as profitable as cable network distribution which has been the cash cow for media giants like Disney for the longest time.

Streaming also requires a lot more content (= rising content investment cost).

To make things worse, this model lacks operating leverage - Without the streaming business, Disney had the option of making content and then distributing it across various third party channels - multiple cable network operators and even licensing their library out to other Streaming companies like Netflix, Prime, etc. But Streaming wars led to more “exclusive” content movement - which basically implied that operating leverage on the produced content was diminished to a large extent.

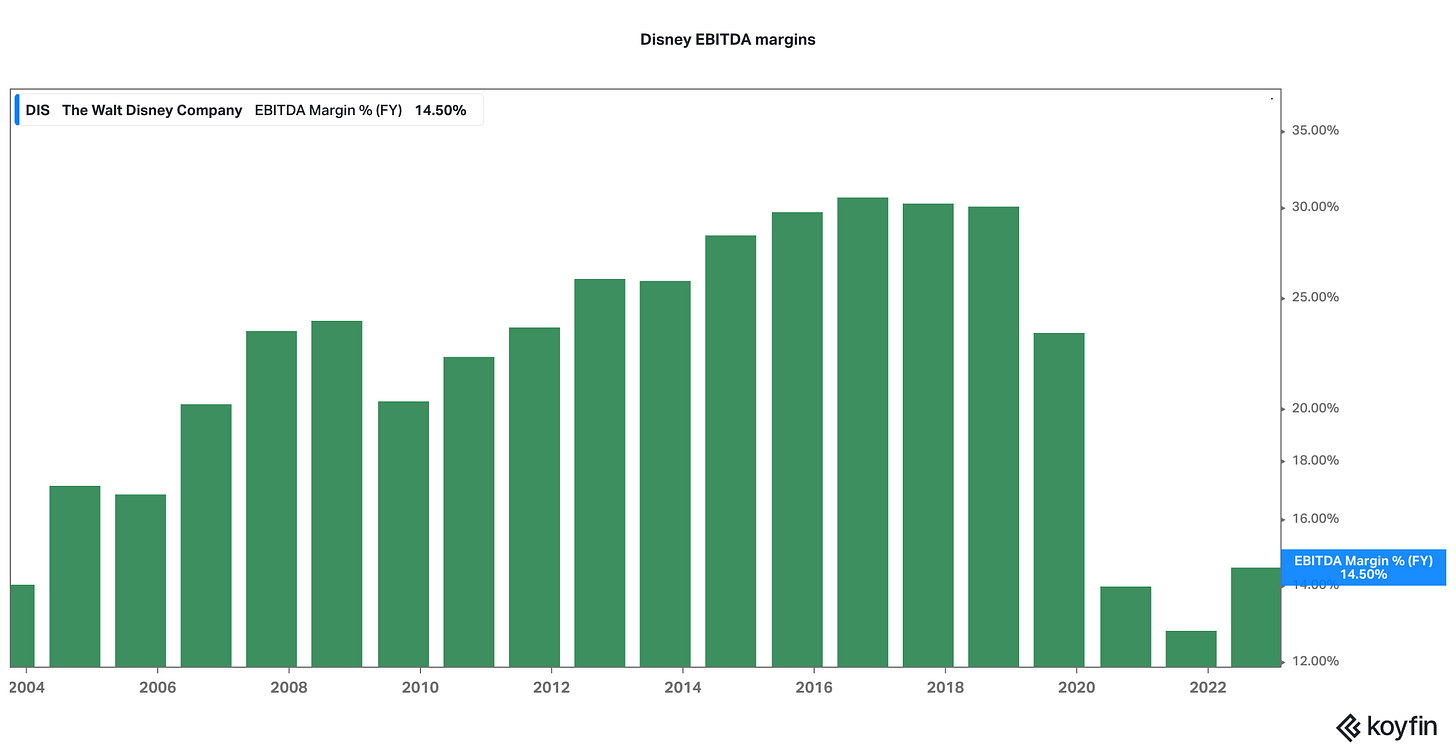

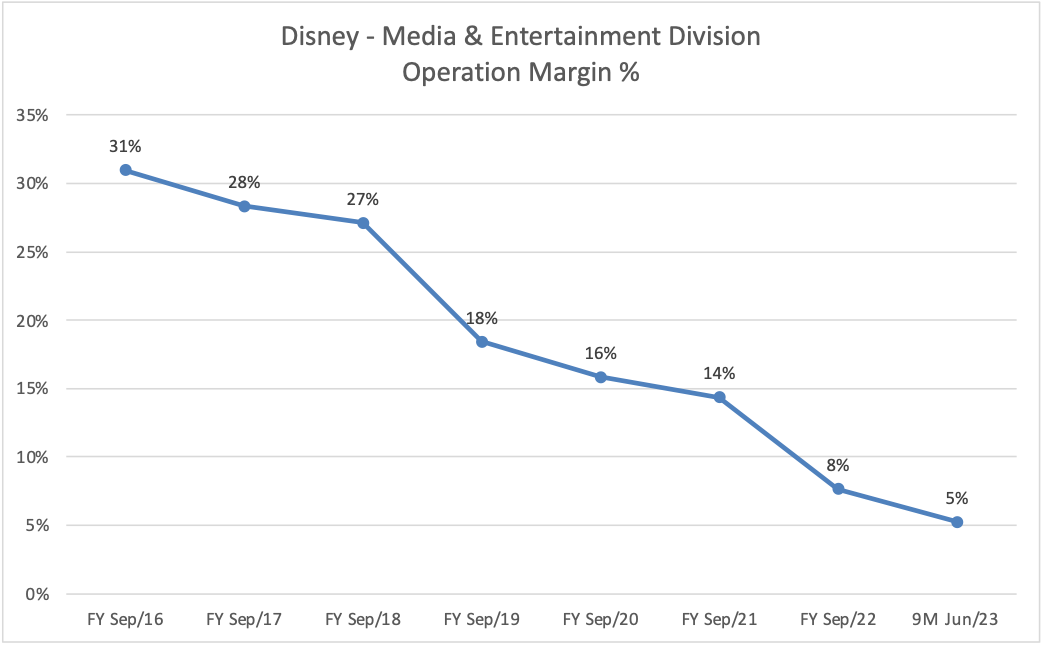

As a result of this shift, the media and entertainment distribution at Disney has seen margins nearly halving versus the pre-streaming times. The cable network business (cash-cow / high margin) is also seeing decelerating revenues.

What could Disney do to evolve its model?

Ads - Well, as with almost all Streaming players including Netflix, Amazon Prime and others, Disney is moving heavily into an advertising model. Ads need to become a sizeable revenue line for direct-to-consumer Streaming business to make sense from profitability perspective.

Bundling Streaming+Cable - In order to salvage the dying cable business (to an extent) AND to expand subscriber base for streaming business, we will see more bundled subscriptions for Cable+Streaming going forward. The latest Disney-Charter deal sets stage for this trend.

Potentially re-licensing content library out to other streaming giants to gain some of that operating leverage back in the production business. Of course, while keeping part of the library exclusive to own channels like Disney+.

Rationalising content cost - The company is getting more disciplined in its content spend, as indicated in most recent earnings calls.

Focus on ESPN - This is one of the crown jewels for Disney as live sports still remains a high demand segment were customers will pay up. The company is currently looking at ways to improve monetisation here through (a) possible partnerships with players like Apple, Amazon to license broadcasting rights or even sell part of its stake and (b) entering into newer growth avenues like sports betting. If (a) materialises, it would be a major positive for Disney.

Margins should improve but won’t go back to their peaks - While all this can help salvage the really dire situation the company is facing today - I have serious doubts that Disney’s media business will ever see the fat 25-30% operating margins it did in the pre-Streaming world. The cash cow is dying - that’s a fact. Therefore, I believe that the SUSTAINABLE operating margins in this segment will improve from here on as above drivers play out but will most definitely never be comparable to earlier highs.

DISNEY PARKS AND EXPERIENCES:

This segment includes Disney’s theme parks, cruises and merchandise.

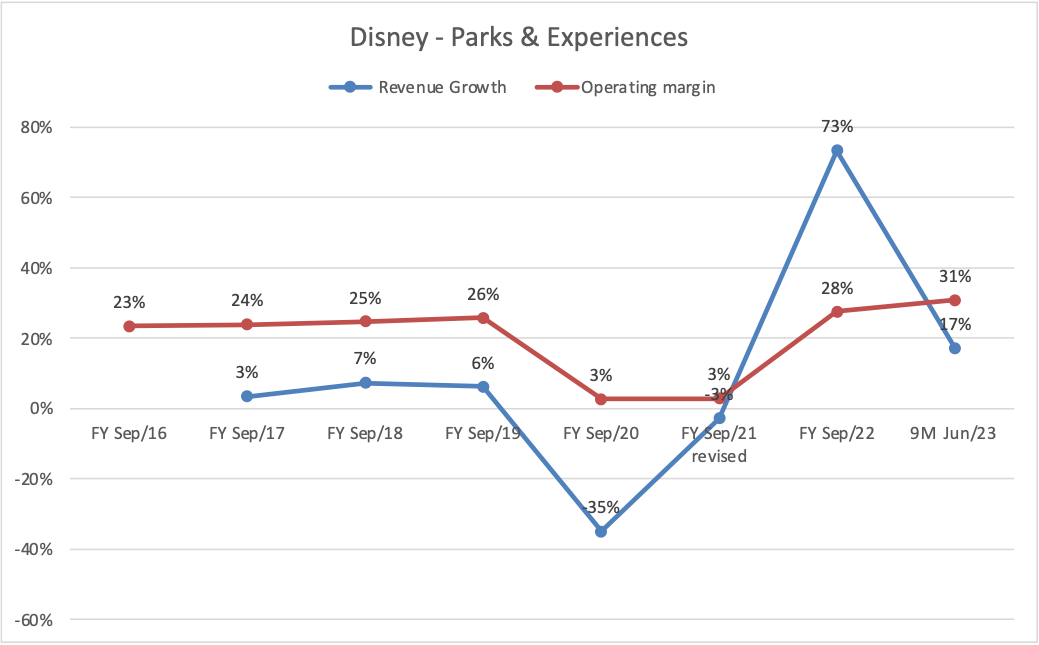

The segment has seen a massive resurgence from post-Covid reopening.

Revenue growth has improved but more importantly, the company has seen a huge margin surge - driven by price hikes and demand increase. And it’s not just in the US but across international markets. See below chart.

Disney is doubling down on this trend - with the recent announcement of doubling its investment into parks and experiences from US$ 30B to US$ 60B in the next ten years.

The big question now is - whether this rise in margins is sustainable or will we see some cooling off? I expect the latter in my valuation assumptions.

OVERALL CORPORATE DEBT:

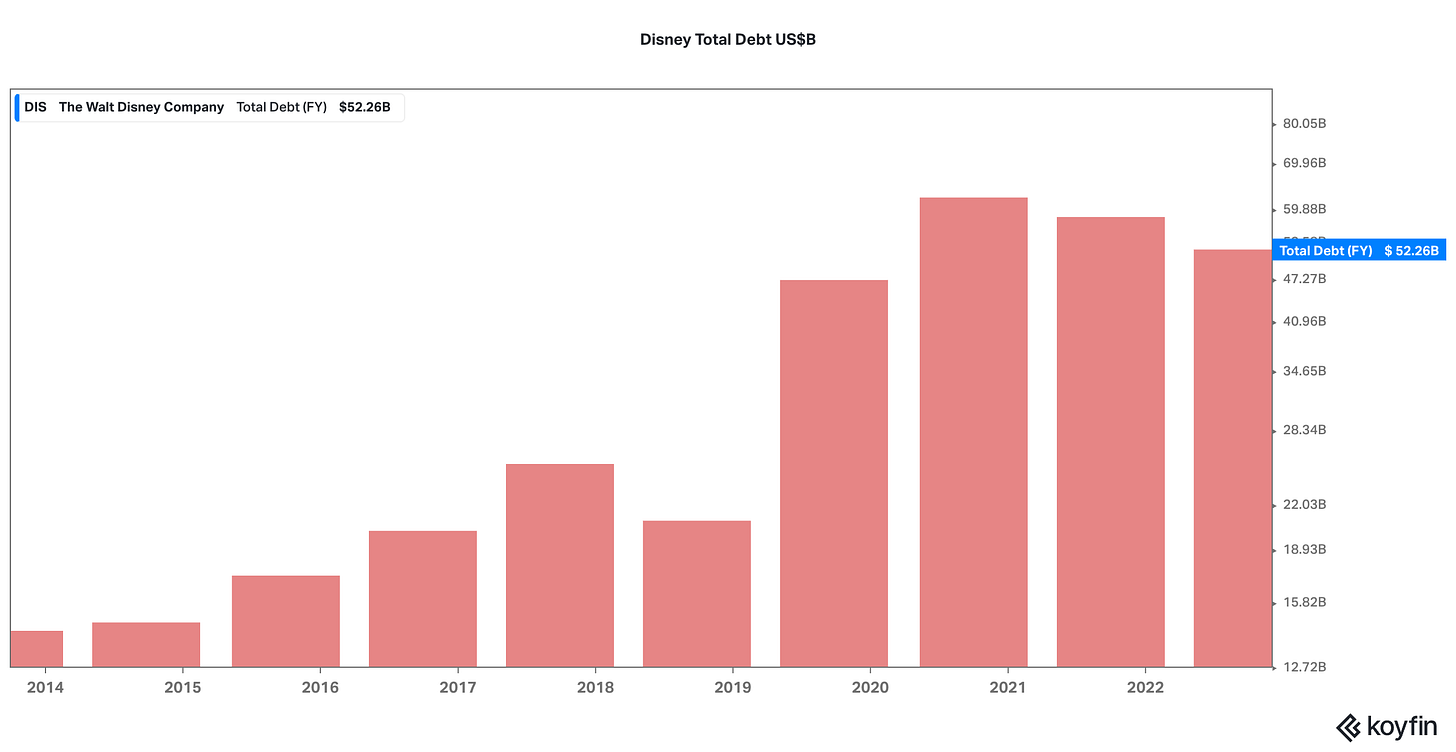

Disney currently has $52B in debt on its balance sheet (versus a $150B market cap). The Fox acquisition in 2019 was one of the major contributors to this and high debt is one of the areas of investor concerns.

To worsen the situation, Disney has some other major investments coming up -

Hulu - Disney owns 2/3rd of Hulu currently and has the right to buy it fully. The negotiations are scheduled for later Sep 2023. It is likely that Disney will end up buying the remaining Hulu stake. The possible additional investment being talked of in media is >US$10B.

Parks investment - The company also has announced raising its investment target in its Parks and Experiences segment by 2X to US$ 60B over the next 10 years.

What could Disney do to lighten up the debt burden?