Biotech Opportunity in China - Part 2

Deep Dive / Zai Lab $ZLAB - A hidden gem in the biotech sell-off

Market cap: US$ 4B

Price Targets: Shared in valuation workings below.

Last week, in Part 1 of this note, I introduced you to China’s Biotech industry. I laid the foundation of how the healthcare landscape in China is changing fast - and the investing opportunities emerging in the biotech space.

I believe the biotech industry in China today is akin to the internet space there some 10+ years ago that gave birth to BABA 0.00%↑ and Tencent or even the EV market a few years back where we saw the rise of companies like NIO and CATL.

If you missed Part 1 of this note last week - you can read it HERE (And yes, these notes are intended to be readable even if you are not a healthcare specialist!)

Now, in this Part 2 of this note, let me share with you how I am playing the China biotech opportunity through ZLAB 0.00%↑ Zai Lab. The stock has both a US and Hong Kong listing - and is therefore, investible for global investors.

If you are a Paid subscriber, you already know that I have been adding to ZLAB recently, per THIS TRADE ALERT I shared 3 weeks back. Since then, the stock has seen a 65%+ return. However, I still think there is a long way to go for this name. How much more? Let’s dive in.

In this note, we’ll cover:

How I came across Zai Lab and Company Overview

Zai’s pipeline of assets

Why has the stock been down so much lately?

5 Reasons why I like the company

Potential Risks

Valuation scenarios and my Price Targets

HOW I CAME ACROSS ZAI - THE BACK STORY

I first came across Zai Lab when I met its management team right after its 2017 IPO at one of the Asia conferences that I attended. At the time, I knew little about the company but after the initial meeting, I was impressed by the management and added it to my “watchlist” names to continue tracking for some time.

And then, I read that the company had signed a partnership with NVCR 0.00%↑ Novocure, which is another company I highly respect. The partnership was essentially to bring Novocure’s flagship tumor treating devices (Optune) to China. That really got me interested in Zai… and then I heard Novocure’s management commentary about how impressed they were with Zai’s execution. Separately, I was also watching Zai’s execution on other fronts by listening into the earnings calls for a few quarters.

Eventually, I was “sold” and have been an investor in the company since a couple of years.

ZAI LAB - COMPANY OVERVIEW

Zai Lab is one of the leading biopharma companies in China.

Founded in 2014 in Shanghai by Samantha Du.

The primary focus for the company has been on cancer, autoimmune and infectious diseases - which are all very large markets in China. Recall that China is the second largest healthcare market in the world.

The business model initially has been to bring innovative globally leading drugs to the local market. In China, most drugs need to go through local clinical trials and approvals before they can be commercialised. Zai, therefore acts as a local partner for global pharma to sell their assets in China after getting necessary approvals, in return for a royalty payment. Given the impressive execution track record (example, getting drug approvals in record times) and the management’s strong reputation, Zai has become a partner of choice for most global pharma companies looking to expand into China.

The company has several leading global companies as its partners today including Novocure, Regeneron and Turning Point.

More recently, the company has also been developing its own in-house assets, which are currently at early clinical trials stages.

PIPELINE OF ASSETS:

For investing in biotech or pharma companies, the most important aspect to study is the pipeline of assets. Typically, as an investor, I do not like taking much clinical trial risk when investing in biotech names (because of the unpredictability of trial outcomes) - which means, that I prefer companies that already have drugs that have been approved for sale by regulators or are near commercialisation stage (what we call Phase 3 and beyond assets).

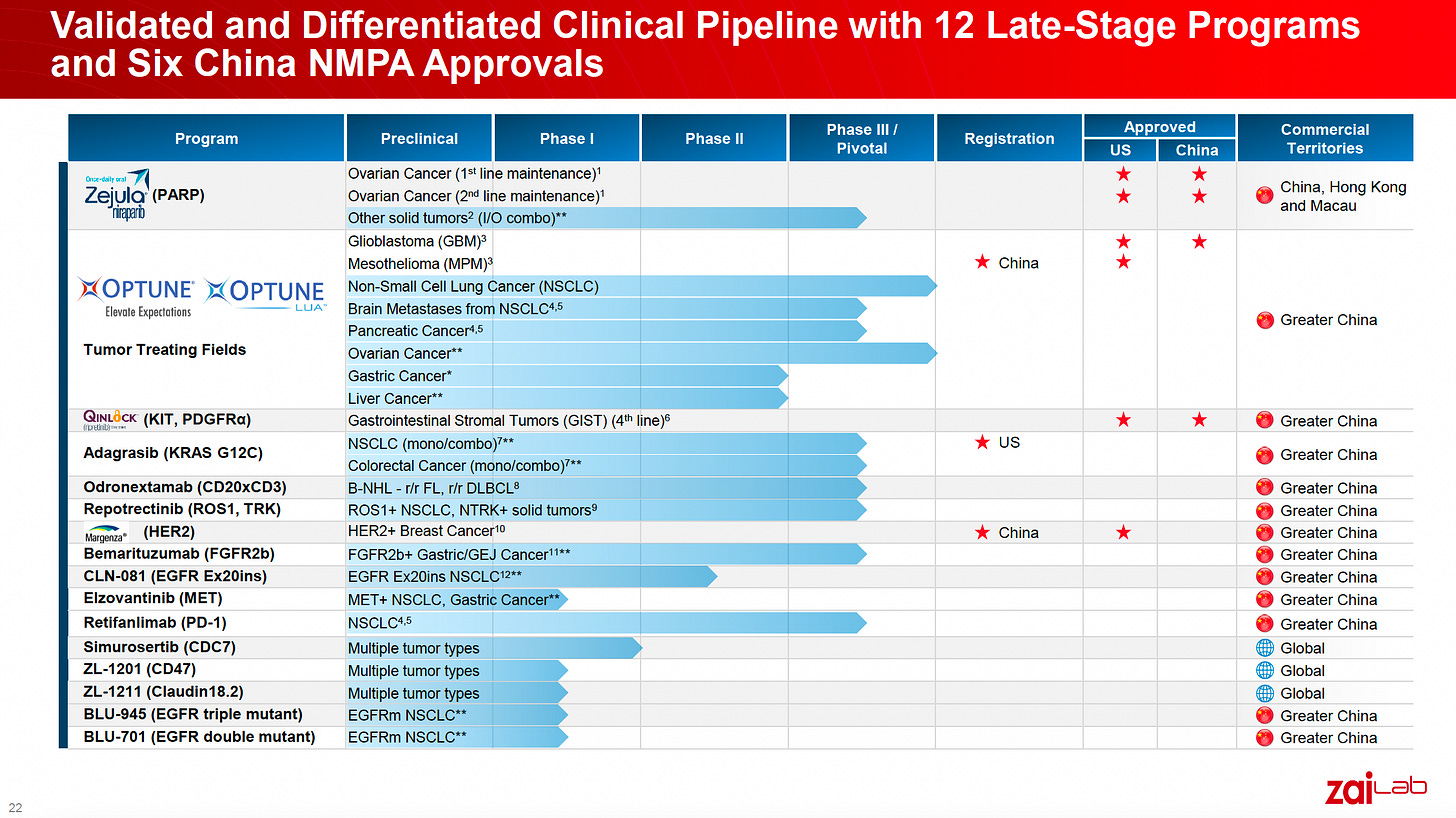

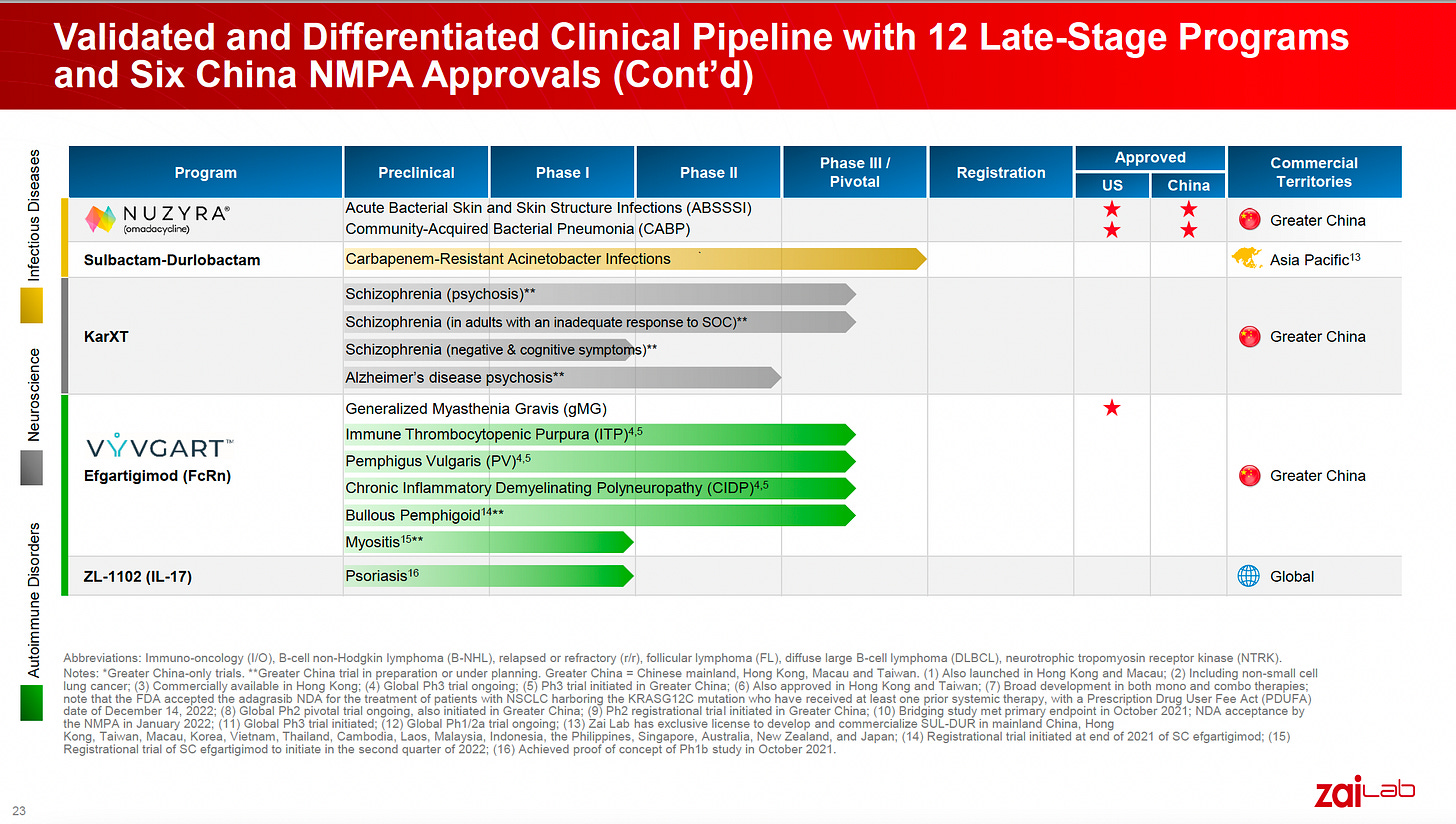

Zai today has a solid pipeline of drugs - 12 late stage (near commercialisation) assets with 4 already approved drugs on the market.

Further, the company has strategically always focused on assets which are are “best in class” for a certain disease or “first in class” innovative drugs. Which, basically implies that there is limited competition for their pipeline and they are able to charge a higher price.

Below is a snapshot of Zai’s extensive drugs pipeline.

WHY HAS THE STOCK BEEN DOWN SO MUCH?

Zai stock is down ~85% from its peak in Jan 2021.

This has been driven by:

Overall Biotech sell-off globally, when the sector became one of the most out-of-favour sectors. I have written about this extensively in previous posts.

China bearishness due to the Covid lockdowns.

China ADR de-listing concerns. However, in April 2022, Zai hired US based KPMG as their auditor, in a bid to meet the US listing requirements for Chinese ADRs. Note, Zai also has a Hong Kong dual-listing (9688 HK).

I believe all these concerns are very much reflected in the valuations and in my view have “bottomed out.”

5 REASONS WHY I LIKE THE COMPANY:

De-risked business model - As I have mentioned above, I focus on biotechs with already approved drugs or near commercialisation assets. Since Zai Lab typically partners with global pharmas that have more later stage / proven assets, it de-risks the asset pipeline for Zai. They currently have 12 late stage drugs in their pipeline with 4 already regulatory approved.

Execution track-record - The company has proven its execution track record both for (a) asset selection - becoming the partner of choice for some of the leading pharma names globally and (b) for taking assets to market in record times.

Balance sheet - In the market environment we are in, balance sheet strength is key. The company has US$ 1.2B of cash currently (relative to a US$ 4B market cap) which is good to fund business development for another ~3 years.