Are we at the cusp of a Credit event?

What's happening, Potential Scenarios and Portfolio Strategy

One of the biggest debates lately has been whether we are at the cusp of a major credit event that could roil global financial markets. In fact, we have dodged a few by a whisker just in the past six months - remember the US regional banks crisis? Or the Credit Suisse mess?

So, in this note, let’s talk about:

What’s causing this debate? The facts.

Potential scenarios from here and my view

And most importantly, Portfolio strategy - how to prepare AND profit from this?

THE FACTS:

You have probably seen a lot of these charts in one form or other scattered across media but let’s get the picture together in one place to be able to make sense of it.

Bond Yields are rising. Fast. Why? Central banks raising rates, “higher for longer inflation” expectations and US government keeps issuing more debt to fund spending (higher supply of bonds = lower bond prices = higher yields).

Chart by Koyfin - Get 10% off the subscription for The Edge readers.

Mortgage rates are rising. Now at some of the highest levels we have seen in the US. Can borrowers keep affording this or start defaulting some time soon?

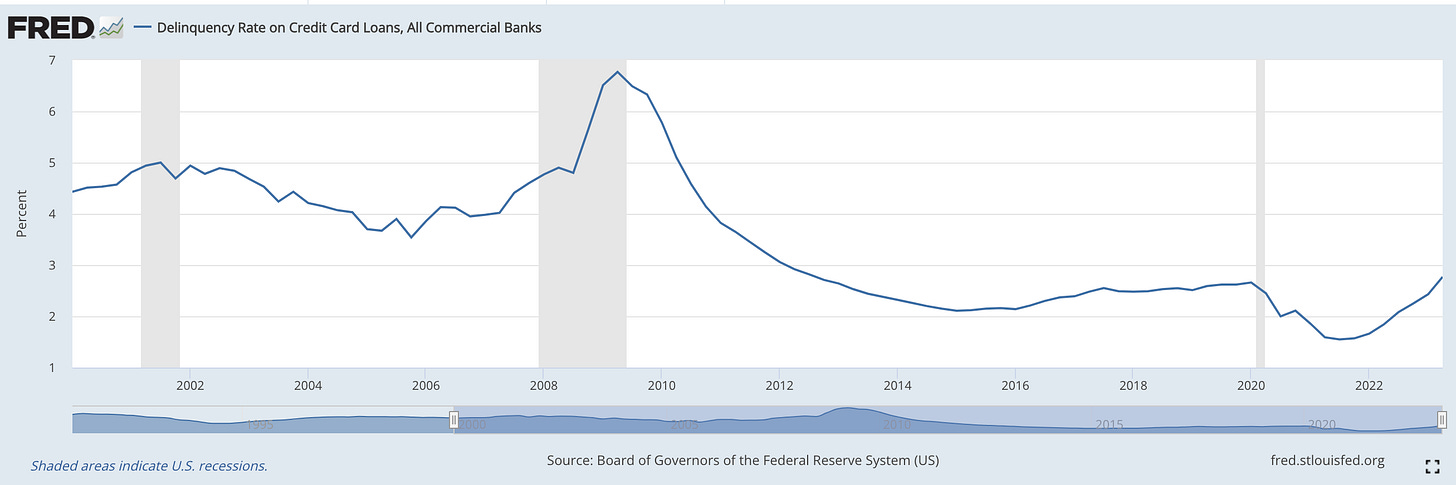

Credit card defaults are rising. At this point, it’s not at alarming levels. But the debate is whether they are just normalising or will we see continued increase in default rates?

Corporate bankruptcies are up materially.

China is seeing rising property sector defaults. This isn’t a result of higher rates per se but liquidity crisis in the country. Could that spiral into something major that affects global markets?

POTENTIAL SCENARIOS FROM HERE:

Before discussing portfolio strategy, let’s think about how things might evolve from here on - the possible scenarios.